Homeowners Insurance in and around Redford

Redford, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

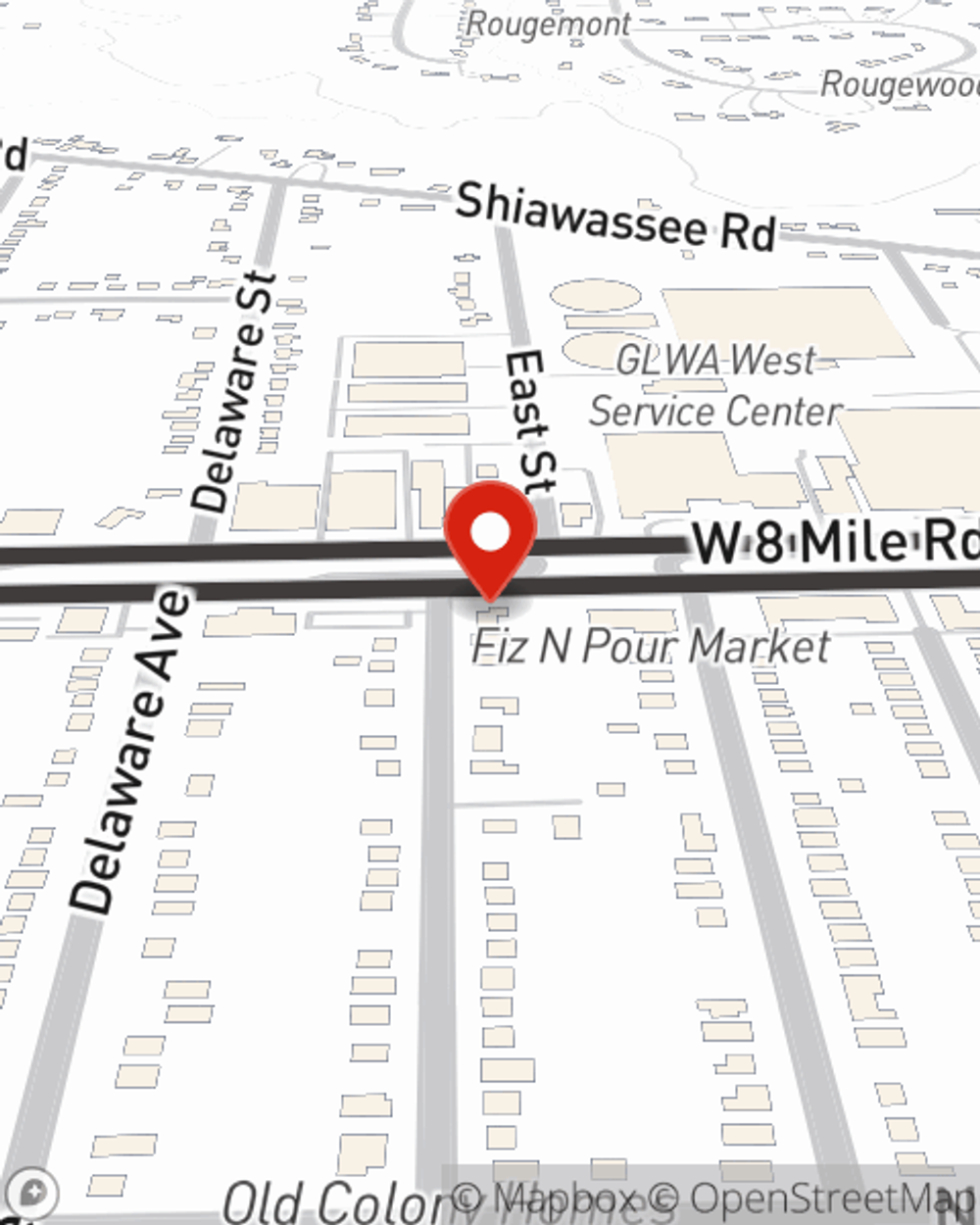

- Redford, MI

- Southfield, MI

- Livonia, MI

- Farmington Hills, MI

- Novi, MI

- Birmingham, MI

- Westland, MI

- Royal Oak, MI

- Detroit, MI

- Metro Detroit Area

- St. Clair Shores, MI

- Northville, MI

- Canton, MI

- Rochester Hills, MI

- Romulus, MI

- Oak Park, MI

- Troy, MI

- Roseville, MI

- Warren, MI

- Shelby Twp, MI

- Clinton Twp, MI

What's More Important Than A Secure Home?

Everyone knows having great home insurance is essential in case of a blizzard, ice storm or tornado. But homeowners insurance is about more than covering natural disaster damage. One important part of home insurance is its ability to protect you in certain legal situations. If someone gets hurt because of negligence on your part, you could be held responsible for their medical bills or physical therapy. With adequate home coverage, your insurance may cover those costs.

Redford, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

With this terrific coverage, no wonder more homeowners select State Farm as their home insurance company over any other insurer. Agent Kyndra Mitchell would love to help you find a policy that fits your needs, just call or email them to get started.

There's nothing better than a clean house and protection with State Farm that is dependable and reliable. Make sure your valuables are covered by contacting Kyndra Mitchell today!

Have More Questions About Homeowners Insurance?

Call Kyndra at (313) 387-9497 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.

Kyndra Mitchell

State Farm® Insurance AgentSimple Insights®

What causes household mold?

What causes household mold?

Here are ways to cleanup and prevent household mold.

How to use your hand tools more safely

How to use your hand tools more safely

Simple safety tips to help you choose and use your hand tools before you start your next DIY project and how to maintain them and protect yourself and others.